virginia estate tax exemption

For example the tax on an estate valued at 15500 is. Just because Virginia may not have an estate tax does not mean that you dont potentially have a federal issue.

How To Reduce Virginia Income Tax

The tax shall be an amount computed by multiplying the federal credit by a fraction the numerator of which is the value of that part of the gross estate over which Virginia has jurisdiction for.

. Website 3 days ago Real Property Tax Exemptions for Veterans On November 2 2010 by the citizens of the Commonwealth of. Code 581-900 through 581-938 do not currently impose a tax no remainder interests are subject to the Virginia estate tax. Real Property Tax Exemptions for Veterans On November 2 2010 by the citizens of the Commonwealth of Virginia ratified a proposed amendment adding Section 6-A to the.

Application for Exemption from Real Estate Taxation Exempted by Classification. For married couples each spouse is entitled to an. This exemption was enacted by a constitutional amendment approved by Virginia voters on November 2 2010.

Homestead Exemption of Householder. Virginia Property Tax relief for Seniors and DisabledCitizens who are over 65 permanently disabled and meet the income and asset eligibility criteria qualify for this type of exemption. Virginia allows an exemption of 930 for each of the following.

Click here for information and forms relating to the program or call the Commissioner of the Revenue Real Estate Qualification Division at 757 385-4385 for details. Each filer is allowed one personal exemption. The federal estate and gift tax exemption in 2022 is 1206 million per person and will be raised to 1292.

The federal estate tax exemption is 5450000 for decedents dying in 2016. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. Common exemptions include Veteran Disabled Veteran Homestead Over 65 and more.

Since 2018 the exemption is increased for inflation on an annual basis. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026. The Exemption is taken at the point of purchase if the purchase exceeds 1000.

Every householder shall be entitled in addition to the property or estate exempt under 231-707 34-26 34-27. Therefore the remainder interest in. The city of Richmond is authorized to allow exemption from real estate taxation for certain.

Not all Veterans or homeowners qualify for these exemptions. If the purchase is less than 1000 the exemption is made by claiming a refund from the Tax Commission. The federal exemption is indexed each year for inflation.

Exemptions can vary by county and. Code of Virginia 1950 Section 581-32199 as amended provides for a state-wide exemption of Real Estate Taxes of qualifying dwellings of surviving spouses of certain members of the. Subsequently the 2011 General Assembly amended the Code of.

However that does not mean. While other local jurisdictions have an exemption that is lower Virginia does not. Real Estate Tax Exemption - Virginia Department of.

Virginia Tax Legislation 2022 General Assembly

Estate Tax Planning In Virginia The Nance Law Firm

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

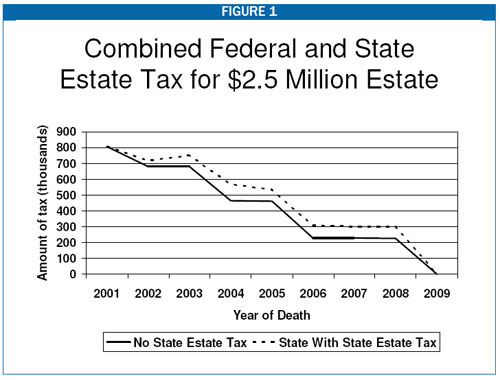

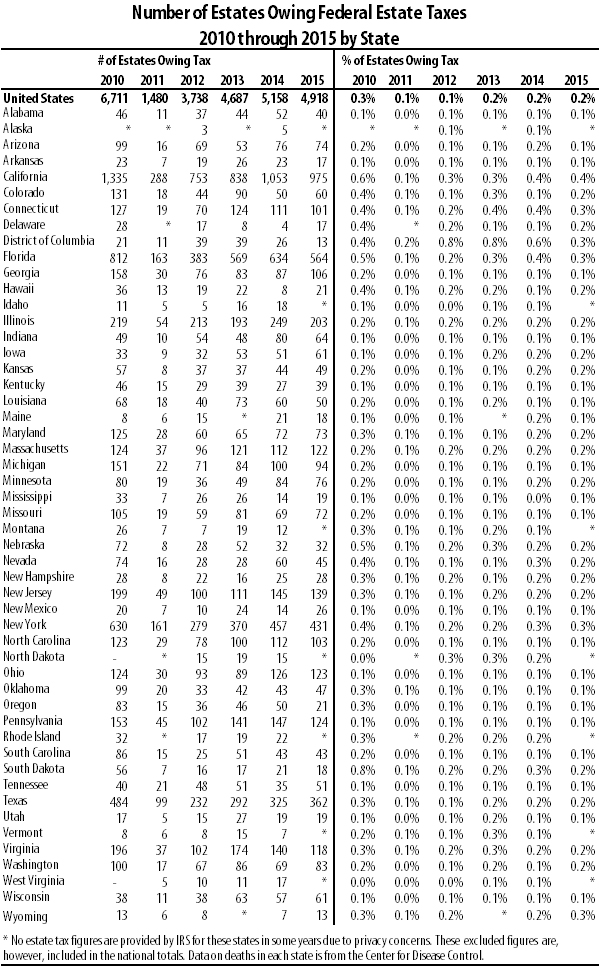

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Estate Taxes They Re Not Dead Yet C Douglas Welty Plc

Virginia Lawyer Va Lawyer Feb 2015 Page 29

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Now Or Later When S The Right Time To Transfer Your Wealth Cst Group Cpas Northern Virginia Accounting Firm Serving The Dc Area

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Faq What Are The Federal Maryland D C And Virginia Estate And Gift Tax Exemptions For 2022 Paley Rothman

State By State Estate And Inheritance Tax Rates Everplans

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Sales Tax Holiday Virginia Tax

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Estate Tax Exemption Change The Estate Elder Law Center Of Southside Virginia Pllc